Genevieve’s 2026 Real Estate Predictions

Last year’s market forecast predicted a rebound and a rise in sales, but that wasn’t exactly how the year started — though it is certainly how it ended! In short, the 2025 spring market was brief and somewhat disappointing for both buyers and sellers, but Charlotte’s fall market proved to be what everyone had been waiting for. When we see a busy fall heading into the holidays, it’s often a sign that January will be off to the races. Here are my predictions for what we expect to see in residential real estate in 2026…

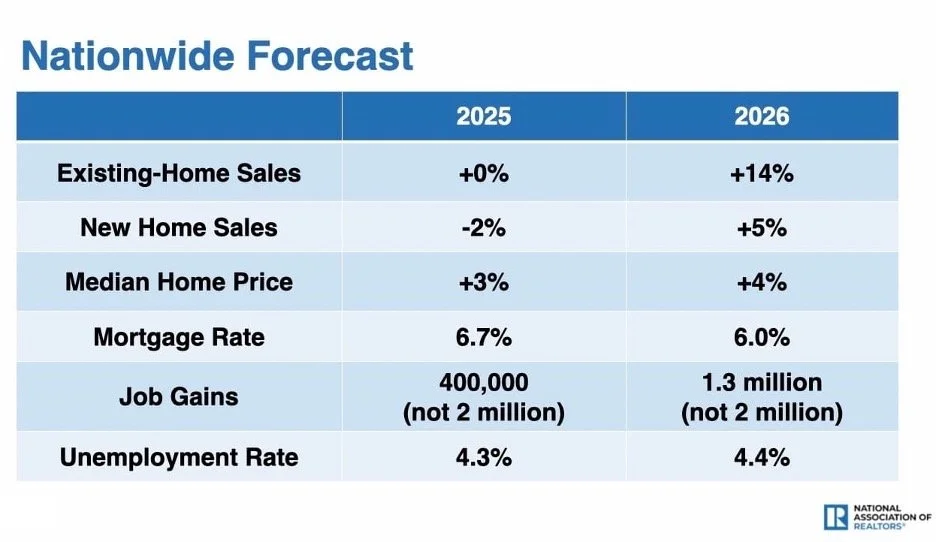

After a somewhat stagnant market in 2025, home sales are projected to rise by 14% nationwide. A rise in sales doesn’t necessarily mean price growth will be out of control like we saw post-COVID though. With interest rates still hovering in the 6% range, the National Association of Realtors (NAR) is projecting a 4% increase in home prices in 2026 (up from 3% in 2025) supported, in part, by steady job growth and ongoing inventory shortages.

Beyond what we experienced in the fall, several indicators suggest the groundwork for a Charlotte rebound is already forming. Data shows mortgage applications are rising, employment gains remain steady, and homebuilders continue to add supply locally.

Mortgage rates are also forecasted to gradually decline. After hitting 7% last year, rates have eased to the low 6’s and may dip into the 5’s this year.

We’re also seeing the upper end of the market outperform the lower end in the Queen City. In a typical, healthy market, lower-end sales feed into higher-end activity, but has anything really been “normal” since 2020? There have been particularly strong gains in the $800K–$2M range, especially in in-town neighborhoods, though this trend is being seen nationwide.

NAR Deputy Chief Economist Jessica Lautz has highlighted the growing divide between buyers with home equity and those trying to enter the market for the first time. “We have haves and have-nots,” Lautz said. First-time buyers now account for just 21% of purchases — an all-time low and well below the historical norm of 40%. The median age of first-time buyers has also climbed to 40 years old, another historic high.

Meanwhile, repeat buyers (especially baby boomers) continue to dominate the market, often purchasing with cash or leveraging years of accumulated home equity. For many of our clients, it’s typically the latter. They’ve seen significant equity gains from purchases made five to ten years ago and are now leveraging that equity to move forward. In fact, 26% of our deals were all cash last year.

Overall, the 2026 forecast is positive, and it appears all the pieces are falling into place for a solid year ahead.

My team and I have been navigating the market in Charlotte for years. We understand the challenges and can take the stresses of managing the full process off your plate. We are here to help anytime. Give us a call.

— Genevieve